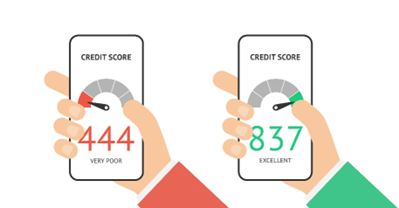

An important consideration for lenders when assessing a loan application is your CIBIL score. Therefore, it is essential to comprehend how the score is determined. A proprietary algorithm determines your CIBIL score. However, the most critical components of the score composition are based on a person’s loan payment history.

A good CIBIL score, and report are crucial in obtaining credit and loans. A low score can result in lenders rejecting your loan application or offering you a loan with a higher interest rate, while a high score can lead to lower interest rates and better loan terms. It is essential to regularly check your CIBIL report and score, as errors or inaccuracies can negatively impact your creditworthiness. You can obtain a free CIBIL report once a year and take steps to improve your score by paying bills on time, lowering your credit card debt, and avoiding applying for too much credit in a short period.

Continue reading and learn more about the CIBIL report, why maintaining the CIBIL report is essential, and how you can download your CIBIL report.

What do you Mean by CIBIL Report?

Credit Information Bureau (India) Limited CIBIL is India’s oldest and largest credit information company. It maintains records of an individual’s credit history, including details of loans and credit cards, payment history, and outstanding debts. This information is collected from banks, financial institutions, and other credit-granting entities and is used to create credit reports.

A CIBIL report is a thorough summary of an individual’s credit history used by banks, lenders, and other financial institutions to assess their creditworthiness. The report contains personal details, employment details, and a complete credit history record, including the type of credit facility, credit limit, loan amount, and repayment history. The report also includes a CIBIL score, a numerical representation of the individual’s creditworthiness based on their credit history. A high CIBIL score indicates a good credit history and increases the chances of getting approved for loans and credit cards. In contrast, a low CIBIL score may indicate a poor credit history and reduce the chances of getting approved for credit facilities.

How to Maintain a Good CIBIL Score

Maintain a good credit score by following the points mentioned below:

- Make On-Time Payments On-time: Overdue payments can significantly impact your credit score, so it is essential to pay all your bills on time.

- Keep Credit Card Balances Low: High credit card balances can indicate to lenders that you may be overextended and unable to repay your debts.

- Limit Hard Inquiries: Hard inquiries are when a lender investigates your credit history to see if you are eligible for a loan or credit card. Too many tricky questions can have a detrimental effect on your credit score. Hard enquiries are made when you file for a loan.

- Diversify your Credit Mix: Your credit score can be improved using various financing options, including credit cards, personal loans, and vehicle loans.

- Monitor your Credit Report Regularly: Regularly checking your credit report can help you identify any errors or fraudulent activities and take necessary actions to correct them.

Reasons to Maintain a Good CIBIL Score

Here are a few reasons mentioned below to maintain a good CIBIL score:

- Loan Approvals: A good CIBIL score can significantly increase your chances of loan approval and help you get better loan terms, lower interest rates, and higher loan amounts.

- Credit Card Approvals: Similarly, a good CIBIL score is crucial for approvals and can lead to better credit card offers.

- Interest Rates: Lenders use CIBIL scores to determine a borrower’s creditworthiness, and a higher score will likely result in lower interest rates on loans and credit cards.

- Insurance Premiums: Insurance companies may also use the CIBIL score to determine the premium for life and general insurance policies. A good score can lead to lower premiums.

- Improved Credit History: Maintaining a good CIBIL score helps build a positive credit history, which can be beneficial when applying for loans or credit products.

Steps to Download the CIBIL Report

The steps may vary depending on the lender. However, generally, you can follow these steps to download a CIBIL report from a lender’s website:

- Visit the lender’s website where you have applied for credit or a loan.

- Look for the “CIBIL Report” or “Credit Report” section on their website.

- Enter your personal information, including your name, date of birth, and address, to verify your identity. You might also have to submit KYC documents for registration. The KYC documents can include Aadhaar card, PAN card etc.

- Enter your contact number. Once the details are filled in, you will receive an email with a link to download your CIBIL report.

- Open the link, sign into your account, and download your information in PDF format.

It’s essential to regularly check your CIBIL report from different sources, including private lenders, to make sure the information it contains is accurate and up to date. A good CIBIL score is essential for obtaining credit and loan approvals, so keeping it in good standing is essential.

Conclusion

A CIBIL report is crucial in maintaining a good credit score and financial health. Following the steps outlined in this guide, you can easily download your CIBIL report and keep track of your credit history. It’s essential to regularly monitor your credit report to ensure accuracy and take the necessary steps to improve your credit score. A good credit score can positively impact your financial well-being and help you secure loans and credit at favourable terms. So, take control of your credit by downloading your CIBIL report today!