- RevPAR grew by 122.9% in Q3 2021 as compared to Q2 2021, due to the strong recovery post the second wave of COVID-19.

- Goa continues to be the RevPAR leader in absolute terms with a 389.8% increase primarily due to the low base of Q3 2020

- In Q3 2021, domestic operators dominated signings over international operators with the ratio of 57:43 in terms of inventory volume

Mumbai: The hospitality industry in India witnessed a growth of 169.4% in Revenue Per Available Room (RevPAR) during Q3 2021 (July – Sep) as compared to Q3 2020, according to JLL’s Hotel Momentum India (HMI) Q3 2021, a quarterly hospitality sector monitor. Furthermore, at a pan India level, there has been a 122.9% growth in RevPAR in Q3 2021 as compared to Q2 2021, due to strong recovery in leisure demand as travel restrictions were eased post the second wave of the pandemic.

The Year on Year (Y-o-Y) growth witnessed in the sector during Q3 2021 is primarily due to the low base effect of Q3 2020 as the nation began to cautiously ease travel restrictions. Post the full and partial lockdowns witnessed in many states during April and May of 2021, the sector witnessed a sharp recovery in leisure travel towards the end of Q2 2021. This trend continued into Q3 2021 as inter-state travel restrictions were further eased and an improvement in travelers’ confidence was seen with the large-scale vaccination drive across the nation.

For the next two quarters (Q4 2021 and Q1 2022), growth in travel is expected to continue as India further ramps up its vaccination rate resulting in improved sentiment towards domestic travel, especially business travel. IT / ITeS companies have indicated that their travel expenditure will increase in the coming quarters as they foresee employees returning to the office/campus as well as resuming travel for work. However, there is a lag between returning to work and subsequent business-related travel. Leisure locations are expected to see a further increase in occupancy and average rates supported mainly by transient leisure and social gatherings.

The total number of signings in Q3 of 2021 stood at 32 hotels comprising of 2,624 keys, recording a growth of 13.4% compared to the same period last year. In line with the overall increasing trend, 15 new signings (47% of total properties signed) are conversions of old hotels. Domestic operators dominated signings over international operators with the ratio of 57:43 in terms of inventory volume.

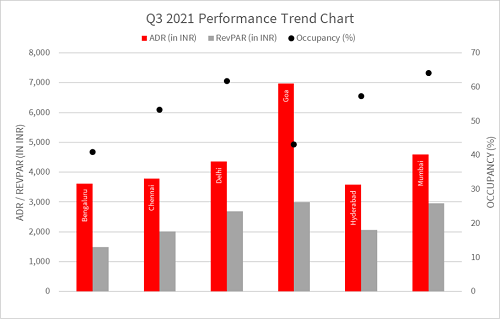

Goa re-emerged as the RevPAR leader in absolute terms in Q3 2021 with a growth of 389.8% as compared to the low base of Q3 2020. Additionally, Hyderabad witnessed the highest growth in occupancy level registering a 33.6%p increase in Q3 2021 over the same period last year. Bengaluru witnessed 213.2% growth in RevPAR followed by Hyderabad with a 173.5% increase compared to the same period of the previous year.

Demand and supply of operational inventory in six major cities increased by 159% and 9.5% respectively in the third quarter of 2021 as compared to the same period last year.

“The sector has witnessed a sharp recovery in Q3 2021 post the second wave of the pandemic. Holiday destinations are sold out on most weekends with domestic tourists deciding to explore different destinations across the nation. Demand for weddings continue to grow as restrictions on large gatherings are further eased. F&B dining has also witnessed a strong recovery both in major metropolitan cities as well as in tier 2 towns, on back of improved market sentiments and growth in vaccination numbers. In this quarter, we have witnessed a slight up-tick in corporate travel as well, which we believe would be a major step towards a full recovery for the sector,” said Jaideep Dang, Managing Director, Hotels and Hospitality Group, South Asia, JLL.